13 February 1997

Source: IEEE Spectrum,

February 1997, Special Issue, pp. 18-80

By TEKLA S. PERRY, Senior Editor

Hard currency is disappearing from many everyday transactions along the road to electronic money. (Text 8K)

By EDWARD W. KELLEY JR., Board of Governors, U.S. Federal Reserve System

The way electronics will fit into the evolution of money -- from acting as a niche player to wreaking major changes in payment systems -- has yet to be determined. (Text 13K)

By MARVIN A. SIRBU, Carengie Mellon University

CyberCash, First Virtual, GC Tech, NetBill -- these and other systems have been developed to enable electronic transfers of payments across the Internet. (Text 37K; 7 images 95K)

BY DAVID CHAUM & STEFAN BRANDS, DigiCash Inc.

Electronic cash can offer transaction privacy to honest users, affords convenient storage and transportation, and protects against loss. (Text 29K; 3 images 55K)

By PETER S. GEMMELL, Sandia National Laboratories

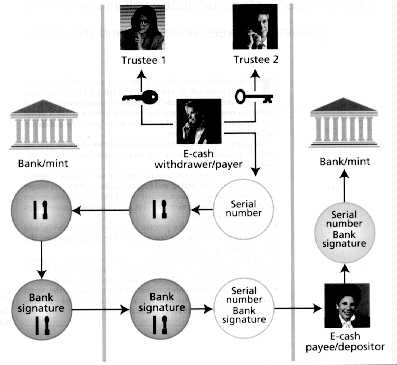

One method of making electronic cash transactions private for honest users but traceable by law enforcement agencies involves the use of trustees. (Text 13K; image 17K)

By STANLEY E. MORRIS, Director, Financial Crimes Enforcement Network

The speed and anonymity of electronic payment systems make them attractive to those pursuing illicit activities. (Text 7K)

BY ROBERT W. BALDWIN & C. VICTOR CHANG, RSA Data Security Inc.

Existing encryption-based security mechanisms can be combined to minimize a wide range of threats to electronic commerce. (Text 42K; 4 images 44K)

By CAROL HOVENGA FANCHER, Motorola, Inc.

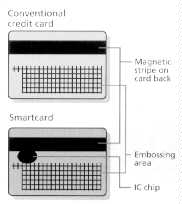

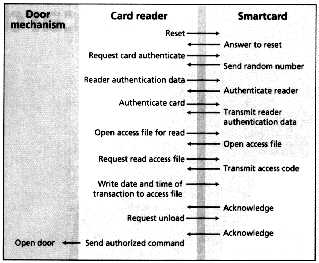

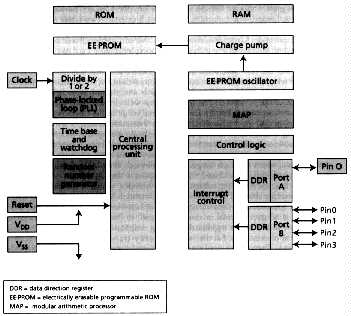

A wallet full of cash, credit, and identification cards may, in the future, be replaced with two or three smartcards, each containing an IC, as a recent flurry of market tests and smartcard rollouts demonstrates. (Text 46K; 3 images 40K)

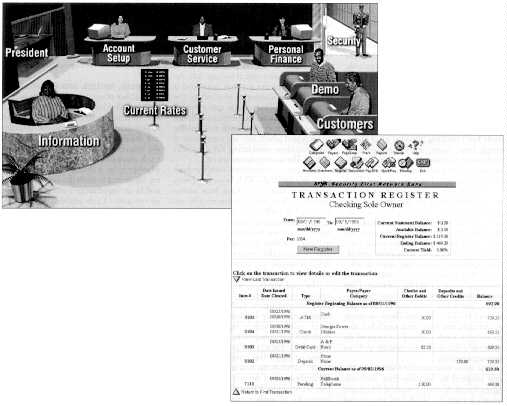

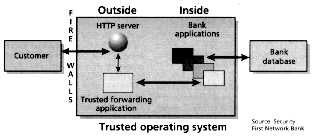

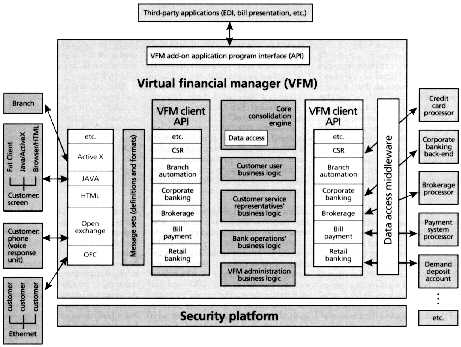

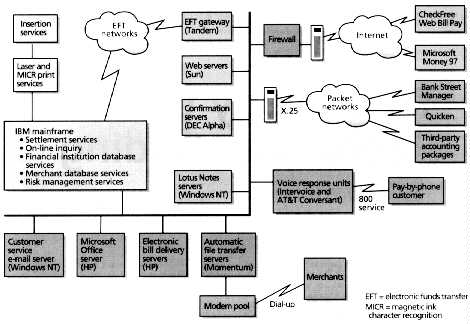

By MICHAEL C. McCHESNEY, Security First Technologies

While home banking has been around for some time Internet banking is a new concept, and has a number of advantages. (Text 36K; 4 images 89K)

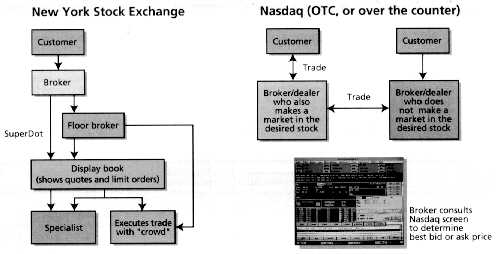

By STEVEN M. H. WALLMAN, U.S. Securities and Exchange Commission

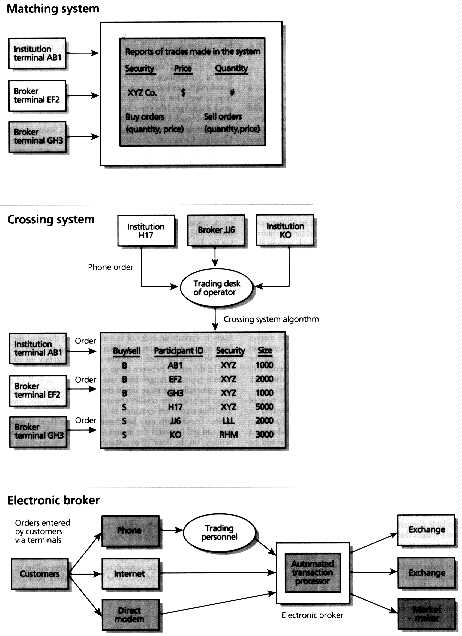

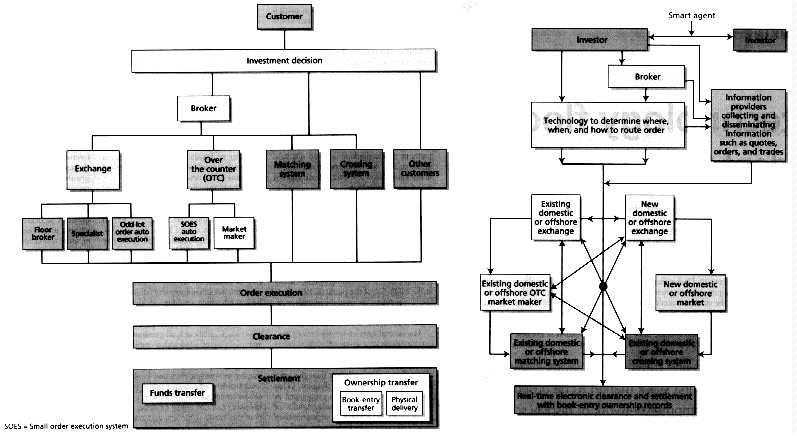

From stock offerings conducted entirely over the Internet, to the automation of traditional exchanges, technology is changing the way stock markets work. (Text 32K; 3 images 98K)

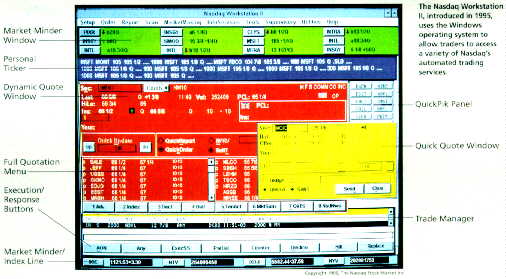

By ALFRED R. BERKELEY III, The Nasdaq Stock Market Inc.

This screen-based stock market has been particularly sensitive to the effects of new computer and communications capabilities. (Text 12K; image 33K)

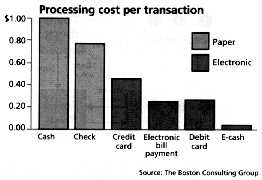

By MIKE ter MAAT, American Bankers Association

Electronic cash can create profits for its issuers, and launch competition for todays government-controlled currency systems. (Text 31K; 3 images 34K)

By HOWARD ANDERSON, The Yankee Group

This visionary sees the e-money revolution as inevitable, with "e-mail for money" becoming as ubiquitous in the future as e-mail messages are already today. (Text 14K)

Paper version of this special issue available from IEEE Spectrum for $10.00.

Thanks to the authors and IEEE.

Hypertext by JYA/Urban Deadline.

By Tekla S. Perry

Senior Editor

I'm not an early adopter of electronic money. I don't use Quicken to balance my checkbook or pay my bills, I don't shop over the Internet ...yet. But on a day-to-day basis, hard currency has already been eliminated from most of my transactions. Many are billed directly to my credit card -- my monthly e-mail fees, my newspaper subscription, catalog purchases, the preschool bill. I also use a credit card for most transactions over US $10. I buy gas at automated pumps: it's faster to swipe a card myself than to walk into the gas station to pay. I pay for groceries in "scrip," a currency issued by my son's school for fund-raising purposes. Just about the only uses I have left for U.S. government currency are buying the occasional cup of coffee and splitting a lunch check with a friend

The authors in this special issue on electronic money paint a world from which even those uses of paper currency can be eliminated. A smart card, loaded with electronic money at an automatic teller machine or, eventually, on a home computer could be used for that coffee and bagel. Technology also exists for "electronic wallets" that can exchange money with each other, making it possible to split a restaurant check electronically or hit up a friend for a few dollars.

The boom of the World Wide Web has intensified interest in electronic money that can be transferred over the Internet. Site operators envision catalog shoppers browsing the Web and doing all their transactions on line; at the rate graphics download on my computer, I can't see that happening any time soon. But they also envision Internet money creating a new type of commerce -- that in information, paid for in fractions of a cent -- that would sustain hordes of Web sites that are currently bleeding red ink. Given a standard currency and an easy way of obtaining that currency on my computer, I wouldn't mind zapping off a few pennies every time I wanted the text of an article -- its cheaper than photocopying charges at my local library.

How will this be implemented? A host of technologies have been developed. Some are still theoretical, some in testing, and some in commercial use. Some involve electronic forms of "cash," others use debit accounts, others are credit-card based. The workings of these systems are explained by Marvin A. Sirbu, a professor at Carnegie Mellon University in Pittsburgh, David Chaum and Stefan Brands, chief technology officer and distinguished scientist, respectively, of Digicash BV in Amsterdam, and Peter S. Gemmell, a senior member of the technical staff at Sandia National Laboratories, Albuquerque, N.M.

The biggest CAUTION/SLOW sign on the road to electronic money is security. There's a significant chance that unauthorized persons will access financial information over the Internet and use it for fraud, and undetectable counterfeiting is also a real concern. So before electronic money becomes pervasive, security must be tight, yet the stuff be simple to use, with transaction details mostly transparent to the user. SET, a security standard for Internet transactions, was created by Visa and MasterCard. Robert W. Baldwin, the senior engineer at RSA Data Security, Redwood City, Calif., responsible for its SET effort, and C. Victor Chang, RSA vice president of engineering, detail today's technology in the rapidly advancing field of electronic transaction security.

Security concerns are also slowing down implementation of electronic banking over the Internet. Citibank chairman John Reed said at a recent conference on electronic money that it will take 50 to 70 years before most of the people who use banks do their business electronically. He indicated that Citicorp considers banking on the Internet off-limits until security issues are solved. But banking on the Internet has begun, with, some feel, strong enough security in place. Michael C. McChesney, chief executive officer of Security First Technologies, Atlanta, Ga., holds that point of view, and explains his firm's electronic banking technology.

As banking moves to the Internet, stock trading is not far behind. The first-ever Web-based initial public offering was conducted a year ago, by Spring Street Brewing Co. of New York City, and since then 30 companies have followed its lead. Traditional stock markets are moving to the Internet as well. Steven M.H. Wallman, a commissioner on the U S Securities and Exchange Commission, discusses that activity and Alfred R. Berkeley III, president of the Nasdaq Stock Market Inc., chimes in with Nasdaq's view of this evolution. (Both organizations are based in Washington, D.C.)

Perhaps the most active segment of the electronic money category in the past year has been smartcards, reviewed by Carol Hovenga Fancher, North American smart card strategic marketing engineer for Motorola Inc., headquartered in Schaumburg, Ill. Though one of the oldest forms of electronic money, in use in Europe for decades, todays generation of smartcards has generated new interest worldwide. Large tests were conducted this past year in the United States at the Atlanta Olympic Games, throughout much of Europe, in Iceland, and elsewhere, even as the technology of the cards themselves was questioned by researchers announcing a theoretical method of breaking algorithms related to smartcard security systems.

Most recently, as this issue went to press, attention was focused on the British-developed Mondex smartcard, with MasterCard International buying 51 percent of the international arm of Mondex International Ltd., London and seven U.S. companies -- Wells Fargo, Chase Manhattan, Dean Witter, AT&T, First Chicago NBD, Michigan National Bank, and MasterCard -- jointly forming Mondex USA and planning a U.S. rollout. Meanwhile American Express Co. has licensed the Proton card, designed by a group of Belgian banks.

All the same, while electronic transactions may simplify commerce for the user, they raise regulatory law enforcement, and economic issues. Today in the United States, where U.S. Comptroller Eugene Ludwig cautions against premature regulation, the government has not begun to regulate electronic money, but is certainly keeping a close eye on the evolving industry. The concerns of the government and economists are discussed by Edward W Kelley, Jr., a member of the Board of Governors of the Federal Reserve System, Stanley Morris director of the U.S. Treasury Department's Financial Crimes Enforcement Network, and Mike ter Maat, a senior economist with the American Bankers Association, Washington, D.C.

So is this world of electronic money coming soon? Howard Anderson, managing director of The Yankee Group, Boston, thinks so, and tells why. Is he right? Do you see electronic money taking over your computer and your wallet? Let IEEE Spectrum know, at http://www.spectrum.ieee.org.

An extensive tutorial on electronic money and Internet commerce appears in Digital Money: The New Era of Internet Commerce, by Daniel C. Lynch and Leslie Lundquist (John Wiley & Sons, New York, 1996).

A conference on the security of digital financial transactions will convene Feb. 24-28 on the island of Anguilla, British West Indies. To obtain program and registration information, see www.cwi.nl/conferences/FC97.

Edward W. Kelley Jr.

Board of Governors of the U.S. Federal Reserve System

Will electronic money become the new medium of exchange, or will it be confined to just a few special niches?

In the long history of how things get paid for, is electronic money the next step?If the issue is how money is transferred, that question is settled -- it is happening now But if it is the creation and acceptability of new forms of money, the jury is out.

Like so many other tools of civilization, money has evolved tremendously over the centuries. While change was glacially slow at first, the pace of evolution has recently been accelerating, and there is no reason at all to think that will stop. But what new forms might money assume? Will electronics take over, and if so, how soon will it do so?

Money has three functions in society, and how well electronics serves these functions will determine its future. First, money is a unit of account, or a way to measure and record value: a pig is worth X dollars. Second, it is a way to store value conveniently for future use; possession of a pig is replaced by possession of a bank account recorded in, and retrievable in, money. Finally, it is a medium of exchange; instead of having first to find a pig to trade for cloth, money buys cloth or a pig.

For money to fulfill these three functions, it must satisfy certain requirements. It should be easily and broadly recognizable and hard to fake (counterfeit), its value should be reasonably stable (a major matter indeed!) and it should be durable and not deteriorate (electronic pulses are potentially wonderful). Finally and crucially, it should be convenient and inexpensive to use (vital for its acceptance in daily commerce).

The history of money illustrates these points. It began, of course, with barter. In a primitive society a pig might be traded for a bolt of cloth. The obvious limitations of this kind of exchange led to the use of proxies for value. In societies near oceans, sea shells served in other places special stones; and later on, pieces of metal, often gold or silver, did duty and came to be shaped into coins. The development of printing spurred the use of paper notes. From this came checks, with which payments could easily be made over a distance, a major breakthrough. When the telegraph was invented, the technology for making remote payments developed further, as transfers became virtually instantaneous. Then a natural extension was the use of modern electronics and computers.

Today, money is transferred in a wide variety of ways. Most of the value moves nearly invisibly to consumers and businesses through what may be termed wholesale payment systems, such as the Federal Reserves Fedwire, and these systems are almost entirely electronic already. But most of the products under development are designed to serve the vast "retail" channels, which encompass the infinity of smaller transactions occurring daily throughout the economy.

How will electronics fit into this matrix of functions and requirements? The products being developed today fall into two groups, and it is important to distinguish between them because only one of them is a new form of money. Those referred to as electronic banking do not represent a new kind of money, but rather offer a new way to access a number of traditional bank services with traditional money. Such activities as bill paying and shifting funds among accounts over a telephone or computer connection belong here, and development is well along in this field. The many emerging types of stored-value cards and other media, however, do create a new money, as they represent an alternative to government-issued or -guaranteed instruments.

In stored-value systems, the liability of the issuer is recorded directly on the card, and a corresponding deposit account is not necessarily maintained for the individual card holder. Innovations of this type are coming along a bit more slowly. To be sure, some systems may involve both stored value and a deposit balance transfer capability, thus integrating the two types of products.

Predictions of an electronics-based cashless society have been around since the 1960s and, at least to date, it has not emerged. Consumers and businesses have proven quite conservative in their money management, relying heavily on tried and true methods even after more advanced techniques have become available. To one degree or another, this conservatism will likely be the case in the future as well. That said, why should the course of events be different now?

The characteristics of e-money and the speed of its advent will depend in large measure upon whether it serves the historic functions of money better than do its existing forms -- whether electronic cash does better as a unit of account, a store of value and a medium of exchange. How acceptable the new products are will be determined by the market and the classic economic factors of basic supply and demand characteristics. Suppliers will have to deliver a product that consumers want to use at a price that they are willing to pay, and that merchants see as a desirable additional way to conduct business.

In determining product prices, the cost factor is always crucial, and engineers designing the product's technical characteristics will have an important influence on these costs. Components will include the costs of cards themselves of terminals, of creating and maintaining software, of obtaining funds and of settlement, and (lest we forget) a profit margin. It is likely that the advance of technology will lower all of these costs continuously.

A long list of features, some essential and others only desirable, will determine the demand for the product. The degree to which these features are incorporated in new products will determine whether e-money does, in point of fact, represent an improvement.

Convenience will be key for everyone. For consumers, this will consist, among other things, of ease in obtaining cards and replenishing them, as well as plenty of opportunity to use them. Merchants will want to see fast and easy service requirements on the part of their staff and fast settlement of the amounts due to them. Privacy may be a tricky issue as consumers will want to keep the details of their transactions private, whereas merchants and issuers will want to ensure they capture an appropriate record of their transactions.

Then there is the all-important issue of safety for the store-of-value devices. Both consumers and merchants will want their stored-value systems to be simple in operation and error free, because neither will favor a device at all likely to somehow eliminate its own value through electronic malfunctioning.

Both consumers and merchants will also demand a high degree of financial stability on the part of the issuer. Otherwise an insolvency may leave the holder with a worthless asset.

All the items on that laundry list have significant technical dimensions, and these technical problems are well on the way to being solved. For instance, engineers have made solid progress in solving the hardware and software issues posed by stored-value cards. Chip cards can now be mass produced, and advanced cryptography techniques are incorporated into the operating systems stored in the chips.

Meanwhile, issuers are confronting the managerial, financial, and legal issues, which could prove far more difficult in many cases. For example, potential issuers are looking into the financial and legal structures that will provide their product with the greatest financial stability while at the same time avoiding the need for regulation, or at least minimizing their costs of complying with regulation.

Governments are keeping a watchful eye on all of this activity, chiefly through their finance ministers and central banks. The Federal Reserve, the central bank of the United States, is closely following several issues. First of all, the safety and soundness of the financial system, especially the banking system, are major concerns as instabilities there can disrupt the economy at large. On this point, the Federal Reserve is unalarmed by developments to date, because market forces should help ensure sound financial practices. After all, consumers and merchants will be most inclined to purchase stored-value products from those issuers who have implemented prudent financial structures and have taken steps to minimize the possibility of fraud.

Furthermore, the stored-value industry appears unlikely to be large enough to threaten the financial system

Then there is the need to protect against crimes such as fraud and money laundering, as well as to ensure the privacy and security of the financial activity of society. The Federal law-enforcement community is looking closely at those issues.

Over the longer term, there could be implications for the control of monetary policy, but I am confident that central banks will be able to adapt their monetary policy procedures to the growth of stored-value products, if the necessity arises. Perhaps most controversial in this context is who should be permitted to issue stored value and under what conditions. While all these issues require resolution, none seems to present insoluble concerns, and the Fed sees no present reason to jump in with preemptive regulations before any clear public policy requirements have been demonstrated. To do that could disrupt the socially beneficial entrepreneurial processes of the private sector and would imply that market forces could not do the job. We believe that they can.

How all this will evolve as time goes along is hard to predict. The large-value wholesale systems are fully electronic already, and while they will no doubt evolve over time, they are not the focus of creative energies in the private sector today. The electronic banking products designed to improve access to existing retail banking functions will almost certainly soon find a place in our financial activities. The stored-value or e-money products could at the least evolve to serve a special niche in small transactions .For larger purchases, the financial incentives may continue to lead consumers to use other means of payment, such as checks and credit cards. It seems unlikely that e-money will make major inroads in the existing order of the financial system for the foreseeable future, but innovation in this area may well lead to noteworthy new efficiencies for the payment system.

One thing I will predict with confidence :the forms of money will continue to evolve, as scientists and engineers continue to advance the applicable technologies.

____________________

About the author

Edward w Kelley Jr. took office as a member of the Board of Governors of the U.S. Federal Reserve System on April 20, 1990, to a full term ending Jan. 31, 2004, after completing an unexpired term from May of 1987. Before becoming a member of the Board, Kelley had been chairman of the board of Investment Advisors Inc., Houston. From 1959 to 1981 he was president and chief executive officer of Kelley Industries Inc., a holding company with subsidiaries in manufacturing, distribution, and business services. Kelley has also been a founding director of three banks in the Houston area.

Brian Madigan, associate director of monetary affairs at the Federal Reserve System, assisted in the preparation of this article.

Governor Edward W. Kelley Jr. of the U.S. Federal Reserve Board has delivered a number of speeches on electronic money. His remarks at the Digital Commerce Conference (May 6, 1996) are available from the Office of Publications, Board of Governors, U.S. Federal Reserve System, Washington, D.C. 20551, 202-452-3245. His speech at the CyberPayments '96 Conference, Dallas (June 18, 1996) can be downloaded from the Internet at www.bog.frb.fed.us/BOARDDOCS/SPEECHES/.

Alan S. Bliner, vice chairman of the U.S. Federal Reserve Board, addressed the topic of electronic money before the Subcommittee on Domestic and International Monetary Policy of the Committee on Banking and Financial Services, U.S. House of Representatives (Oct. 11, 1995). His remarks may be obtained from the Office of Publications, Board of Governors, U.S. Federal Reserve System, Washington, D.C. 20551; 202-452-3245.

MARVIN A. SIRBU

Carnegie Mellon University

A plethora of technologies and business models are in development to enable electronic payments

Since the advent of banking in the Middle Ages, bank customers have used paper-based instruments to move money between accounts. In the past 25 years, electronic messages moving through private networks have replaced paper for most of the value exchanged among banks each day. With the arrival of the Internet as a mass market data network, new technologies and business models are being developed to facilitate electronic credit and debit transfers by ordinary consumers.

These new systems include CyberCash (which is a gateway between the Internet and the authorization networks of the major credit cards) and the Secure Electronic Transactions protocol (a standard for presenting credit card transactions on the Internet), as well as First Virtual (a way of using e-mail to secure approval for credit card purchases of information), GC Tech (a payment system that can use credit or debit via an intermediation server), and NetBill (a public-private-key encryption system for purchasing information).

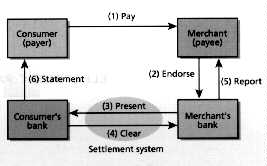

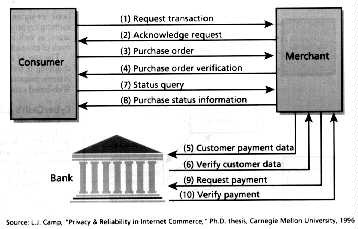

In today's banking world, money consists of ledger entries on the books of banks or other financial institutions. A checking account, also known as a demand deposit account (DDA), records deposits by the consumer and can be used, via the consumers instructions in the form of a check, to make payments to third parties. Typically, a check is written by a consumer authenticated by signature, and presented to a merchant, who may endorse it with a signature before presenting it to a bank for payment. If the merchant's bank and the consumer's bank are the same, it can simply transfer the funds on its ledgers from the consumers account to the merchants. If the payer and the payee keep accounts at different banks, the payee bank presents the check for settlement to the payers bank and receives the funds in return through a settlement system. Several private check clearinghouse systems, as well as the Federal Reserve system, provide settlement services in the United States [Fig 1].

[1] This simplified model shows the steps involved in processing standard paper checks used by a consumer to pay a merchant.

When checks are sent to banks for deposit, merchants do not yet know if consumers have adequate funds and therefore need to find out whether the checks cleared. Similarly, consumers receive statements from their banks showing which checks have been paid. Any discrepancy between bank records and those of the payers may indicate that forged checks were presented against consumers accounts.

This model works equally well when there is a negative balance in consumers' accounts, at least if the consumers' banks are willing to extend credit -- that is, to lend the consumers funds needed to pay off the checks.

Many banks in the United States and Europe provide such credit facilities, sometimes referred to as "overdraft protection." A credit card is another example of an account that lends money to the consumer.

The simple model below illustrates the major issues that must be addressed in designing an electronic credit or debit system.

Such a system does exist for paper checks. In the United States and Canada a bank identification code and account numbers are encoded in magnetic ink on the check. But the naming of accounts is not standardized internationally. Payees provide their account numbers when endorsing checks. The payers' banks match the signatures on checks with customers' signatures on file at banks. Integrity is ensured by the use of special paper and the practice of writing checks in ink with no alterations. The U.S. Federal Reserve system provides a vehicle for settlement and confirmation takes the form of periodic statements or special notices for bounced checks. If checks are presented in person or mailed in sealed envelopes they are generally protected from observation by third parties.

From a business perspective, payment systems differ in the warranties the different parties make and in the liabilities they assume. For example, the payers' banks are responsible for verifying signatures on checks. If this fails to happen, the payers are not liable for forged checks drawn on their accounts It is possible to cut the cost of the entire process if payment messages can be readily tied to the parties' accounting systems -- for instance, by including purchase order numbers or a consumers account number with a merchant on all checks. It may also be desirable to link payment to some proof that merchandise has been delivered. These links to other processes are among the principal benefits of electronic payments.

In a payment processing system, the cost of normal operations is frequently outweighed by the costs associated with exception handling. If a typical transaction costs US 5 cents to process, and the manual labor associated with handling errors and exceptions comes to an average of $25, even with an error rate of only two per thousand, exception costs will equal normal processing costs. As electronic processing drives down the cost of normal transactions, exception handling becomes relatively more significant. Payment systems must therefore be implemented to the highest standards of reliability, with automated procedures for recovering from errors whenever possible.

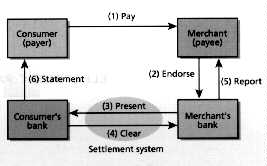

The credit card system was designed to provide immediate gratification of the wants of consumers by allowing them to purchase goods or services on credit. A credit card is a token of trust that transfers the risk of granting credit from a merchant to the card-issuing bank. Once a merchant has had a purchase authorized by the card issuer over the private authorization network, the merchant is assured of payment and the card issuer assumes responsibility for billing the consumer and collecting the money. Settlement takes place later, when the merchant periodically submits a batch of authorized transactions to the merchant's (acquiring) bank for settlement with the card issuer. But the issuers assumption of risk is limited, however, to "card-present" transactions, such as those taking place in retail stores. When a merchant accepts a credit card by mail or phone ("card not present"), the card issuer accepts only the risk of nonpayment; the merchant bears the risk of fraudulent card usage. Merchants pay the costs of credit card use because selling on credit expands their business. Under U.S. law, a consumers liability if someone else fraudulently uses the consumers card is limited to $50 [Fig. 2].

[2] In this model of credit card transactions, consumers present their cards to the merchants who submit the card numbers and transaction details to the authorization system, which either approves transactions directly or routes the requests to the card issuing bank for approval. Periodically -- for example, at the end of the day -- merchants submit details on approved transactions to their banks. This information is submitted to the card association for settlement after a bank nets out transactions for which it serves as both card issuer and acquirer.

In a card-present transaction, the merchant validates the payers signature by matching the one on the back of the card against the one on the charge slip. Integrity is protected by the device of giving the consumer a carbon copy of the slip. The consumer's account number is verified by the embossed number on the credit card. Settlement is handled by card associations (such as Visa and MasterCard). The merchant receives immediate confirmation of a transaction while submitting it for authorization by way of the card associations private data network.

When a catalog sale takes place by mail or phone, the merchant has no way of verifying the consumer's right to use the card number proffered At best, the merchant can request the consumer's billing address and receive an address verification. In effect, a credit card purchase requires only that the card number be conveyed from buyer to seller. For this reason, consumers are asked to protect their credit card numbers.

While conventional checking and credit card systems may seem quite similar the legal meaning of credit card and check payment differ significantly Credit card companies warrant their merchants; a person can challenge a credit card charge if dissatisfied with the goods. Checks provide no such recourse. If a person buys a plane ticket on an airline with a check, and the airline goes bankrupt before the ticket can be used, the unlucky purchaser becomes an unsecured creditor, behind many other claimants. By contrast, someone who pays for a ticket with a credit card may claim restitution from the card-issuing bank, and the card issuer in turn is entitled to redress from the airline's bank, which must stand behind the airline.

Payment systems vary significantly in their allocation of liability and in the warranties made by the different parties. Technical mechanisms have a strong influence on the willingness of parties to assume liability. If only the payers bank can verify a signature on a check, the merchant or payee bank will not assume any liability for fraudulent signatures. But if public-key-based "signatures" make it possible for a merchant to verify them on an electronic check, merchants can be expected to undertake verification as they now do in card-present transactions.

Translating checks or credit card transactions to the Internet requires finding electronic and business model equivalents for the functions described above.

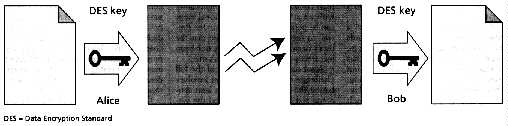

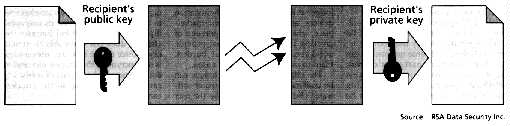

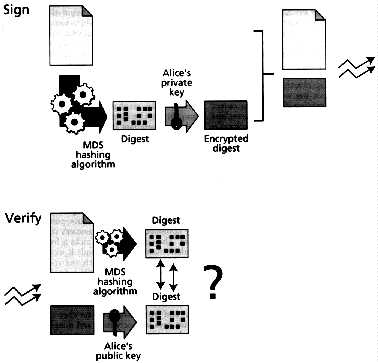

Signatures and confidentiality are the two biggest problems in creating digital payment instruments. These issues are typically handled with some form of cryptography. The use of public-private-key pairs allows a message to be "signed" digitally and verified by anyone who has the public key. Some form of public-key infrastructure, such as certificates, must be employed to associate a named user or an account unambiguously with a particular public key. Message digests provide integrity.

Most payment systems require special consumer and merchant software to prepare and process electronic payment messages. Although the consumer software is often described as an "electronic wallet," that term is misleading; funds are never kept in the wallet, which acts rather as an electronic checkbook for signing payment orders -- managing keys, performing cryptographic operations, and formatting messages, as well as acting as a check register for keeping track of transactions.

The use of credit cards over the phone for catalog shopping is well established. Some of the first Internet systems propose to extend that model to shopping from Web-based catalogs.

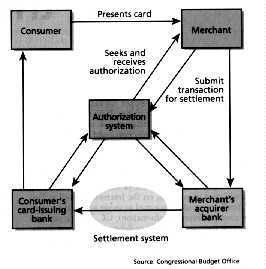

CyberCash Inc., Reston, Va., implemented a system for protecting credit card presentation on the Internet in April 1995. The system was one of the first of its kind. The company, which provides software to both consumers and merchants, operates a gateway between the Internet and the authorization networks of the major credit card brands. As Nathaniel Borenstein, chief technical officer for First Virtual Holdings Inc., San Diego, Calif., noted, "Debugging obscure problems with incompatible implementations of Internet protocols is not a core competence of most financial institutions" -- hence the role for a gateway service.

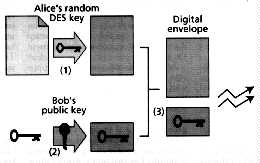

The consumer begins by downloading the wallet software, which supports encryption and transaction record keeping. Like a physical wallet that may hold a number of credit cards, the software wallet can be used by the consumer to register several credit cards. Another software package provides similar services to the merchant. Messages are encrypted using a random symmetric key, which in turn is included in the message encrypted under the recipient's public key The CyberCash public key is built into the wallet and merchant software. Consumers generate a public-private-key pair when they register credit cards with the wallet software, and the public key is sent to CyberCash, where it is maintained in a database. While consumers, merchants and CyberCash all have public-private-key pairs, only CyberCash knows for certain everyone's public key. As a result, the company can exchange information securely with consumers or merchants, but they communicate with one another in the clear, relying on CyberCash to authenticate all signatures [Fig. 3].

[3] CyberCash Inc., Reston, Va., provides consumer software, merchant software, and a gateway to support the secure communication of credit card transactions over the Internet.

When the time comes to make a purchase, the consumer requests the item desired by selecting it with a Web browser. The merchant's server sends the wallet software a cleartext, signed payment-request message that describes the purchase and indicates which credit cards the merchant accepts. The wallet software thereupon displays a window that lets the consumer select which credit card to use, and approve the purchase and the amount.

A credit card payment message, including a signed and encrypted description of the transaction, along with the consumer's credit card number, is sent back to the merchant, which forwards the payment message, along with the merchant's own signed and encrypted description of the transaction, to the CyberCash gateway. There, CyberCash decrypts and compares the two messages and their signatures. If they match, it submits a conventional authorization request and returns the charge response to the merchant, whose software confirms the purchase to the consumer's wallet software (credit card response). Additional messages cover refunds, voiding transactions, capture, and status inquiries.

CyberCash operates its gateway as an agent of the merchant's (acquiring) bank. Thus it must be trusted to decrypt the information for resending over conventional authorization networks.

Since the information is encrypted under CyberCash's public key, the merchant does not actually see the consumers credit card number -- a procedure that in theory cuts the risk that customer credit card numbers will be abused. In practice, so many catalog companies organize their customer marketing records by credit card numbers that an acquirer usually authorizes CyberCash to provide them to merchants on request.

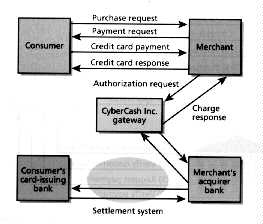

In February 1996, Visa and MasterCard announced their joint support of a standard protocol, dubbed Secure Electronic Transactions (SET), for presenting credit card transactions on the Internet. SET is designed to operate both in real time, as on the World Wide Web, and in a store-and-forward environment, such as e-mail. As an open standard, it is also designed to permit consumer, merchant, and banking software companies to develop software for their respective clienteles independently and to have them interoperate successfully.

In the CyberCash protocol, only CyberCash knows everyone's public key. SET, however, assumes the existence of a hierarchy of certificate authorities that vouch for the binding between a user and a public key. Consumers, merchants, and acquirers must exchange certificates before a party can know what public key to employ to encrypt a message for a particular correspondent [Fig. 4].

[4] The operation of the Secure Electronic Transaction (SET) protocol relies on a sequence of messages. In the first two, the consumer and merchant signal their intention to do business and then exchange certificates and establish a transaction ID number. In the third step, the consumer purchase request contains a signed hash of the goods and services order, which is negotiated outside the protocol. This request is accompanied by the consumer's credit card information, encrypted so that only the merchant's acquiring bank can read it. At this point, the merchant can acknowledge the order to the customer, seeking authorization later (steps five and six) or perform steps five and six first and confirm authorization in step four. Steps seven and eight give the consumer a query capability, while the merchant uses steps nine and ten to submit authorizations for capture and settlement.

Although the software industry is moving rapidly to implement SET, the protocol poses significant problems for banks. Card issuers must invest considerable sums to have public key pairs and certificates issued to their card holders. Yet the benefits to the SET card issuers are not clear. A standard protocol may reduce software costs to merchants and consumers, as well as inhibit merchant fraud, but the cost of such dishonesty is borne by the acquirers, not the card issuers. What is more, it is not clear that SET will generate significant new credit card volume, as opposed to merely displacing mail and telephone orders. The card associations suggest that SET transactions, like card present ones, should involve lower payments to card issuers Thus a shift from telephone orders to SET could actually reduce the revenues of card issuers, while increasing costs by requiring them to issue certificates. Aligning benefits with costs will require a reallocation of the merchant discount between issuers and acquirers, a politically difficult task for card associations.

First Virtual provides a mechanism that lets information providers accept credit cards for Internet purchases without resorting to cryptography. Consumers establish account IDs with First Virtual and fax or telephone their credit card numbers to it. To buy information, consumers present those account IDs to merchants, who then connect to the First Virtual server to verify that IDs are valid if so the information is sent directly to the consumers. The server then sends them an e-mail message asking if they are willing to pay for the information. Consumers e-mail a reply indicating "yes," "no," or "fraud" If the answer is yes, First Virtual submits the user's credit card number through its acquirer, and the consumer's card is charged. After holding the funds for 90 days, the company transfers them to the merchant by means of an automated clearing house.

The First Virtual model has several key premises. First, consumers do not really know if they want a piece of information until they have looked at it. Second, the cost of sending information electronically "on approval" is negligible, so a merchant has lost very little if a consumers answer is "no." Third, most consumers are honest: they will not systematically order goods and then answer "no" even when they are satisfied. (As an added deterrent to dishonest behavior, First Virtual will cancel a consumer's account if the pattern of usage suggests abuse.) By not charging consumers until they are satisfied, the system eliminates the cost of reversing charges for information that was not delivered as a result of network or computer problems.

Since the request for payment approval comes by e-mail, while goods are typically delivered over the Web, First Virtual believes that its model is so hard for an attacker to abuse that the risks are justified. Moreover, because the company delays payment to merchants for 90 days, consumers have plenty of time to discover fraudulent charges on their credit card statements, in which case First Virtual can easily reimburse the credit card with the funds it is holding.

In the First Virtual model, naming is provided by the account ID. In lieu of signatures, the company relies on the integrity of the Internet's e-mail infrastructure to ensure that a real consumer is answering yes or no. There is no message confidentiality, except that the account IDs may be viewed as pseudonyms. Confirmation is provided by e-mail and credit card statements. Settlement is handled first by the credit-card provider transferring payment to First Virtual and then First Virtual transferring payment to the merchants.

The company has been in operation since October 1994. It claims more than 180,000 consumer accounts.

Beginning in the early 1970s, banks began searching for ways to reduce the costs of check processing (6.5 cents -13 cents per item) by handling payments electronically. In direct payroll deposit, an employer sends a list of payroll payments to its bank, which then transfers funds to the employees' accounts at their banks through one of several automated clearinghouses (ACH). Consumers use direct payment to deal with recurring bills, such as utility, mortgage, and auto loan payments. In 1995, four ACH operators -- the Federal Reserve, the New York Clearinghouse, the Arizona Clearinghouse, and VisaNet ACH Services -- handled 2.9 billion transactions worth $13 trillion on their private electronic networks. The cost to banks was only half of what they would have spent processing checks manually. Payers and payees saved even more.

For both direct payroll deposit (used today by more than 45 percent of the U S. workforce) and for direct payments, transactions begin when a large organization sends a batch file or tape to its bank with a list of payments or requests for payment. Because this is a batch system it can take as many as three days for a payee to receive confirmation that a payment has cleared. The existence of these ACH systems for settlement between banks provides a strong base on which to build consumer-oriented electronic payment systems that can accept individual electronic requests for payment originating with consumers.

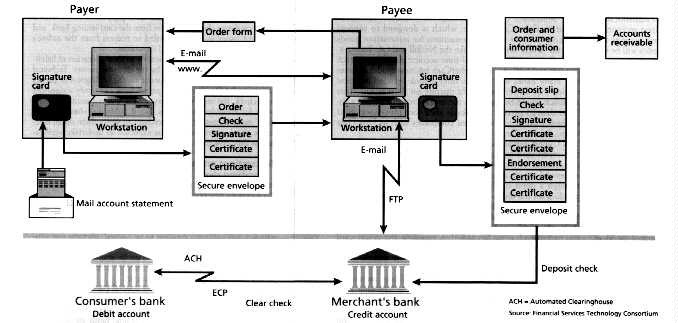

On the Internet, a paper check can readily be replaced by a digitally signed message -- that is, an electronic check. A consortium of banks working through the Financial Services Technology Consortium (FSTC) Inc. has demonstrated a prototype electronic check system that maps directly into the model described above for conventional checks. The payer uses a secure processor, in the form of a PC card, to generate a digitally signed payment instruction, or "check," that is transmitted to the premises of the merchant where it is "endorsed" digitally before it is sent on to the merchants bank. There, the check can be settled through an existing ACH [Fig. 5]. Other scenarios are also supported, for example, payers can send electronic checks to their own banks which would then transfer funds directly to the payees' banks.

[5] In the electronic check concept developed by Financial Services Technology Consortium Inc., consumers uses smartcards or secure processors to compose and sign electronic checks. A check is sent, together with the consumers' public-key certificates and transaction details, to the payee for endorsement. The payee then adds its own signature and certificates and sends the check to its bank for deposit. The results of transactions are reported to both merchants and consumers.

Standards for conveying invoice and remittance information so that payments can be readily linked into accounts payable and accounts receivable processing systems are an important component of the electronic check concept.

The FSTC model assumes that public keys and certificates are widely available, with banks vouching for their customers and associations of banks, such as an ACH, vouching for one another. The insistence on a hardware token for protecting a private key is designed to provide a high level of protection against such threats as Trojan horse software.

To the extent that FSTCs electronic checks rely on the conventional ACH system for clearing, they cannot give the merchant immediate payment confirmation of the sort provided by credit card authorization. CyberCash, Carnegie Mellon University, and GC Tech have introduced, or are developing, low-cost debit payment systems that give a merchant an immediate assurance that the payment will go through

These systems provide a service model based on the concept of an on-line bank account, with immediate posting of transactions so that payees can get real-time confirmation that funds are available. In addition, they offer an interface to existing electronic funds-transfer mechanisms, including both ACHs and credit cards, so that consumers can easily transfer funds between their primary banks or credit accounts and their Internet payment accounts. Furthermore, these systems aggregate many on-line transactions for batch settlement over traditional settlement networks. They differ in the order of steps required for a transaction, in the consumer protection they provide in the event that goods are not delivered, and in the balance they strike between computationally expensive public-key cryptography and the use of shared-key cryptography.

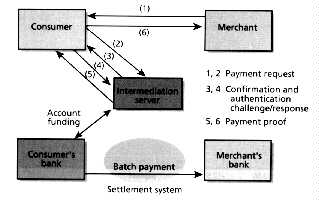

GC Tech SA, headquartered in Paris, France, bases its business model on turnkey payment systems software for banks and other financial institutions [Fig. 6] The intermediation server in the GC Tech model maintains a "ledger" of consumer funds on account in the payment system. These funds may actually be on deposit at the consumers bank, but their disposition is accounted for on the intermediation servers books. Account funding may take the form of a charge against the consumer's credit card or a transfer from the consumers checking account to the payment system account. A consumer opens an account by downloading the wallet software and specifying a credit card used to fund the account.

[6] The payment system protocol from GC Tech SA, headquartered in Paris, France, revolves around an intermediation server that maintains account information for consumers and merchants. Merchant requests for payment are relayed by way of consumers' wallets to the intermediation server, which authenticates the consumers and returns through them a confirmation to the merchant that he will be paid.

When the consumer has selected a product for purchase, the merchant responds with a digitally signed payment-request message that is sent to the consumer's electronic wallet, which verifies the terms of the transaction and forwards the message to the intermediation server. The server then issues an authentication challenge to the consumers wallet software. Upon receiving a correct response, the server debits the consumers account and credits the merchant. Accumulated merchant credits will be settled in a single periodic batch transaction. If the consumer has sufficient funds, the server returns a digitally signed proof of payment (PPT) to the consumer's wallet software, which forwards it to the merchant. Assured of payment, the merchant can now deliver the goods.

The GC Tech cryptographic model assumes that the intermediation server and the merchant have public-private-key pairs, while consumers have only a PIN number When the consumer forwards the proof of payment to the server, it proposes a session key encrypted under the server's public one. This session key is used to encrypt the authentication challenge and response, as well as to protect the PIN from disclosure. The proof of payment, signed by the servers private key, can be independently verified by both consumers and merchants. This model eliminates the need to issue and manage certificates for consumers.

Various entities are expected to use the GC Tech system, marketed under the brand name GlobeID. The GlobeID operator in France is Kleline SA, a joint venture operated by Moet Hennessey Luis Vuitton SA and Compagnie Bancaire SA, all three of which are in Paris. U.S. operations are expected to start in early 1997.

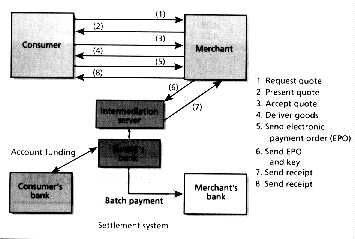

NetBill, a system under development at Carnegie Mellon University (CMU) Pittsburgh, in cooperation with Mellon Bank Corp., also in Pittsburgh, is optimized for delivering such information goods as text, images, and software over the Internet. Its developers, who include the author, have stressed the importance of guaranteeing that consumers receive the information they pay for. To that end, consumers are not charged until the information has actually been delivered to them. Similarly, merchants are guaranteed payment for goods delivered. The basic NetBill protocol has eight steps, beginning with the authentication of identity (using public-key cryptography) and ending with the transmission of a decryption key to the consumer so that the information being purchased can be decrypted and presented [Fig. 7].

[7] The NetBill payment protocol has eight steps. In the first, the consumer and merchant authenticate each other using their public-key certificates and establish a symmetric session key to protect the privacy of subsequent messages. The first message requests a quote based on the consumer's identity, to allow for customized per-user pricing, such as volume discounts or support for subscriptions. If the quote (step two) is accepted (step three), the merchant sends the digital information to the consumer (step four) but encrypts it and withholds the key. The consumer software constructs an electronic payment order (EPO) describing the transaction and including a cryptographic checksum of the goods received. The order is signed with the consumer's private key and sent to the merchant, who verifies all its contents, appends the key for decrypting the goods, endorses the EPO with a digital signature, and sends it on to the NetBill server. The NetBill server verifies funds in the consumer's NetBill account, debiting the consumer and crediting the merchant, and a digitally signed receipt, including the key to decrypt the goods, is sent first to the merchant and then on to the consumer. The consumer software can now decrypt the purchased information and present it to the consumer.

In this system, consumers are not charged until the (encrypted) goods reach them. At the same time, if there is not enough money in the consumers account, the transaction will he rejected and the key never delivered, preventing the consumer from using information that has not been paid for. The merchant's endorsement of the electronic payment order also serves as a warranty that what was received by the consumer is what the merchant intended to deliver. In the unlikely event that the merchant or client machine goes down after the consumer has been charged but before the key is delivered, the consumer can request a copy of the receipt -- which contains the key -- from the NetBill server.

Note the contrast in message flows between the GC Tech and NetBill systems. GC Tech requires merchants to communicate with the intermediary by way of the consumer's software. In a NetBill microtransaction, only the merchant talks directly to the accounting server.

NetBill will fund its accounts by charging the credit cards of consumers to put spending money in their NetBill accounts. These funds will be held at NetBill's bank. As merchants accumulate credit balances, funds will be transferred via VisaNet to the merchants' banks.

CMU and Mellon Bank expect to launch a commercial trial of the NetBill system in the first half of 1997. Transaction fees, paid by the merchant, are expected to range from 2.5 cents on a 10 cent transaction to 7 cents on a $1 transaction.

In September 1996, CyberCash Inc., Reston, Va., introduced its CyberCoin service, which is designed to support low-cost (25 cent to $10) transactions for information goods over the World Wide Web. Like the NetBill and GC Tech systems this one relies on a real-time account database to track Internet transactions. The CyberCash business model assumes that many banks will want to offer a bank-branded payment service that CyberCash would operate on their behalf. This approach would be similar to the recent trend in credit cards: fewer than 25 percent of banks do their own processing; most of them leave it to specialized companies such as First Data Corp., Atlanta. Ga.

A CyberCoin account can be "loaded" either by a charge to a credit card or by a transfer from the consumer's checking account. In the latter case, the transfer is handled in one of several ways as an ACH transaction, by direct access through a debit or ATM network, or by other means. Depending on the mode of access and the user's level of authorization, funds may become available immediately or held for as many as three days until the transaction clears While it is less costly to the intermediary to obtain the funds through the clearing house -- thus avoiding the credit card discount fee -- consumers are likely to prefer credit cards that give them instant access to the funds and 30 days before they have to pay the bill.

In the CyberCoin system, like the NetBill one, merchants deliver the goods encrypted and provide the key only after payment is confirmed. But rather than using RSA digital signatures on every small transaction, the CyberCoin system uses asymmetric cryptography only to load accounts and establish a session key. Individual transactions are then signed with this symmetric key, thus reducing the data processing burden.

CyberCash has established partnerships with a number of important players. Netscape, for one, has agreed to bundle the CyberCash wallet software with its browser software products.

Payment systems can be expected to go on proliferating for the next several years, until the market determines the most desirable combinations of functions, price, and performance The paper world, after all, has many different instruments, which embody different tradeoffs among risk, cost, complexity, responsiveness, and the time until the transaction is final. The same variety should be expected in electronic credit and debit systems.

Yet new technologies uncover new ways to distribute risk, liability, and cost among the parties to a transaction, so that new financial instruments with no comparable paper analog, are also to be expected They will take somewhat longer to develop, however, as they require changes in regulatory assumptions, case law, and participant behavior, all of which evolve much more slowly than technology does.

____________________

About the author

Marvin Sirbu holds a joint appointment as professor in the departments of Engineering and Public Policy, the Graduate School of Industrial Administration, and Electrical and Computer Engineering, at Carnegie Mellon University, Pittsburgh. In 1989 he founded the university's Information Networking Institute, which is concerned with interdisciplinary research and education at the intersection of telecommunications, computing, business, and policy studies. Before joining Carnegie Mellon in 1985, he taught in the Sloan School of Management at the Massachusetts Institute of Technology, where he also directed a research program on communications policy.

Providers of Internet payment systems maintain extensive Internet Web sites replete with information about their systems: CyberCash (www.cybercash.com/), FSTC (www.fstc.org/), NetBill (www.ini.cmu.edu:80/netbill/), First Virtual (www.fv.com:80/), GC Tech (www.gctec.com/), and SET (www.mastercard.com/).

B. Clifford Neuman and Gennady Medvinsky discuss on-line payments in "Requirements for Network Payment: The NetCheque Perspective," in Proceedings of the IEEE Compcon '95 (March 5-9,1995), pp. 32-37.

The U.S. Congressional Budget Office has published a report on cyberpayments: Emerging Electronic Methods for Making Retail Payments (Government Printing Office, Washington, D.C., June 1996).

"Privacy & Reliability in Internet Commerce" is the subject of L. J. Camp's doctoral dissertation (Department of Engineering and Public Policy, Carnegie Mellon University, Pittsburgh, Pa., August, 1996).

David Chaum and Stefan Brands

DigiCash Inc.

Electronic equivalents of traditional cash payment systems are being launched worldwide

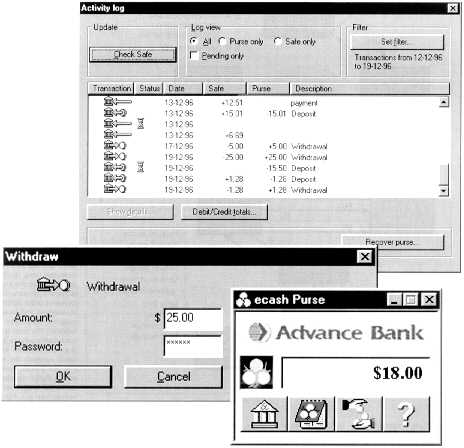

Customers of Australia's Advance Bank can avail themselves of its electronic cash software. The topmost screen shows transaction history -- personal information stored on the user's computer and not accessible by the bank or by anyone else.

The bottom screen shows the user interface. The readout states the amount of Australian dollars stored in the form of this electronic cash on the user's computer. The buttons access [from left] bank account information, the log of transactions, payment controls, and help system.

The remaining screen shows the user withdrawing 25 Australian dollars from the bank onto his or her computer. The password unlocks the user's secret key, which is then used to authenticate the withdrawal.

The interest in electronic replacements tor traditional forms of payment has exploded in recent years. In addition to many field trials tor value stored in chips on plastic cards (smartcards), many major software, telecommunications and financial services organizations are working on their own electronic payment techniques. While most of these aim at enhancing credit cards, a few companies have gone further and developed electronic replacements of traditional cash payment. However, the extent to which the different systems succeed in preserving the unique benefits of traditional cash and exploiting the new mediums advantages varies substantially.

Traditional cash money is a bearer instrument. It allows instantaneous payment from person to person. Cash payments are not normally traceable by a third party and therefore offer privacy. On the other hand, transporting, protecting, and refreshing coins and bank notes make them very costly for banks to handle. Bank notes can be forged on sophisticated color copier machines, coins are too heavy to carry around in any large number and both are easily lost or stolen. Because coins are virtually indistinguishable, and coins and bank notes can be passed from person to person many times without the involvement of a bank or other third party, cash is the preferred method of payment in criminal activities like extortion, money laundering, and bribery. Another inherent shortcoming has become particularly confining of late: the requirement for physical proximity of payer and payee.

The introduction of debit and credit cards has helped to overcome many of these problems. With these payment forms the actual value resides at all times within the banks and so the risks of large-scale theft and loss are reduced. A fundamental problem of these payment forms is that payments must be verified on-line by the bank; this makes transactions more expensive and can lead to unacceptable delays. Another problem is that the actual transfer of value is performed by banks, from source to destination account, and thus payments are inherently traceable. This traceability enables intensive profiling of spending behavior and, by inference, all sorts of other characteristics on personal information. Data protection laws can offer only limited protection against criminal use of spending and inferred habits, since such use typically becomes visible (if at all) only once the damage has already been done.

Electronic cash can combine the benefits of traditional cash with those of payment by debit and credit card, while circumventing both their shortcomings. As with traditional cash, electronic cash should have high acceptability and be suitable for low-value payment from person to person. With the possible exception of on-line payment platforms such as the Internet, it is preferred that payments be verifiable off-line without the banks involvement, for reasons of cost-effectiveness and speed. To facilitate electronic cash payments over the phone and the Internet, physical proximity of payer and payee should not be necessary.

Moreover, electronic cash should offer privacy of payments. In particular, payments by an honest payer should be untraceable, and information about transaction content should remain privy to payer and payee. Yet a payer ought always to be able to trace the payee; traceability suits electronic cash just as little to extortion, money laundering and bribery as a check or wire transfer. Lastly, as with payments by debit and credit card, electronic cash should be convenient to store and transport, while protecting users against loss, theft, and accidental destruction.

Each participant in an electronic cash system is represented by at least one hardware device, equipped with a chip having computing capabilities and nonvolatile memory. How to embody the devices depends on the target payment platform (say, a PC, possibly in combination with a PC Card or a smartcard, may be used for Internet payments, while a hand-held device with display and keyboard is more appropriate for on-the-street payment); the offered functionality (smartcards may be most appropriate for purposes of cross-platform portability); and the required security and privacy levels. When the holder of an account at a bank that issues electronic cash wants to withdraw some of it, his computing device engages in an execution of a withdrawal protocol with a computing device of the bank, when connected to one of its terminals (by direct or infrared communication, dial-in, the Internet or other methods). At the end of the protocol execution the computing device of the account holder holds an amount of electronic cash, represented in some suitable form, and his bank has charged the account holder by taking an equivalent amount of traditional money out of his bank account and moving it into a float pool; electronic cash is pre-paid by the account holder

To transmit to a payee who accepts electronic cash issued by the payer's bank, the account holder connects his computing device to that of the payee (again, by direct or remote communication), and the two computing devices execute a payment protocol. As a result, the representation of the electronic cash amount held by the account holder's device is adjusted to reflect the new amount. In the case the payers bank is not involved in the payment, the payees computing device should correspondingly represent in some way the received payment amount; this is called an off-line payment. Otherwise, the payee must communicate with the bank during the payment; this is called an online payment.

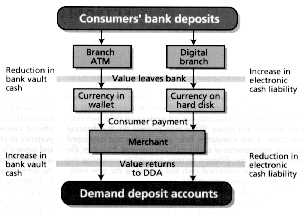

Ultimately, a party holding electronic cash will need to sell it back to the issuing bank. Redemption is needed in most systems because electronic cash received in one payment cannot be reused in subsequent payments, or can be reused only up to a predetermined number of times. To this end, the party connects his computing device to a terminal of the issuing bank (or of his own bank, which can then settle with the issuing bank), either by direct or remote communication, and a deposit protocol is performed. As a result, the account of the party depositing the electronic cash is credited with an equivalent amount of money [Fig 1].

[1] Electronic cash works like traditional cash for the consumer but not for the bank. In an ATM transaction [left], the cash given to the consumer constitutes a reduction in vault cash. In a withdrawal of electronic cash [right], the value is moved within the bank and becomes a liability that is reversed when the electronic cash is presented, either on-line or off-line, for deposit.

Of utmost importance for the security of any electronic cash system is that an attacker cannot inject extra money into the system. In effect, receiving devices must be able to distinguish authentic paying devices from attackers that try to pass for paying devices. To prove their authenticity, paying devices need to be equipped by the bank with secret keys. Correspondingly, receiving devices must be able to recognize whether they are communicating with a device holding a secret key installed by the bank.

A secure authentication protocol should resist replay. In this kind of attack, a wire-tapped transcript of an execution of an authentication protocol is reused by an attacker in order to pass for a paying device The paying device should therefore perform a computation (presented by the other device in the form of a challenge) that is feasible only when knowing the secret key, rather than transmitting the secret key itself. The outcome of the computation is called the response to the challenge, and should be verifiable by the receiving device; this enables it to conclude that the outcome must have been generated by a paying device that holds the secret key.

One way for a receiving device to verify the response of a paying device is to have prior knowledge of the latter's secret key. The receiving device then simply computes the response to its own challenge as well, and verifies it for equality with the response provided; this process is known as symmetric authentication. Receiving devices need to know (or be able to generate) the secret keys of all the paying devices they have to conduct transactions with, and for this reason they must be tamper-resistant as well. Hence they must be issued by or on behalf of the bank which takes care of installing the keys of all paying and receiving devices.

Since it is dangerous to have all paying devices use the same secret key, yet cumbersome for receiving devices to store and maintain unique keys the recommended approach is to use so-called "diversified" keys. In this method, each receiving device stores a master key, generated at random and installed by the bank. The secret key of a paying device is computed as a function of the master key and an ID number unique to the paying device. This function should be such that the master key cannot be computed from a device secret key. In case a paying device has its key extracted by an attacker, and so can be simulated, the compromised device can be traced and blacklisted as soon as the fraud is detected.

A weak point of symmetric authentication is the presence of the master key in all receiving devices, so that a successful attack on any one of them enables an attacker to simulate any paying device. This vulnerability vanishes when asymmetric instead of symmetric authentication is used. As before, to prove its authenticity to a receiving device, the paying device computes a response, known as a digital signature, which is based on its secret key and a challenge; but this time to verify the response, the receiving device applies a public key of the paying device, corresponding to its secret key. Knowledge of the public key does not enable the computation of the secret key, so that receiving devices need not contain secrets that are correlated to secret keys of paying devices.

Another advantage over symmetric authentication is that digital signatures cannot be forged. The receiving device can subsequently demonstrate to the bank (or to other devices) that the proof took place by showing the digital signature of the paying device. There is no need for receiving devices to be tamper-resistant.

Two fundamental ways exist for representing electronic cash in computing devices, whether paying or receiving devices. First is to indicate the amount of electronic cash by means of the value of a counter, maintained in a chip register. For example, 100 electronic dollars spendable in 1-cent increments would be represented by a counter value of 10 000. This representation is referred to as register-based cash Since money can be forged when counters can be updated without bank authorization or bypassed, security relies critically on the tamper-resistance of the devices.

When an authentication method is combined with a register-based cash representation in paying devices, the paying device as well as the amount that is transferred must be authenticated. To this end the receiving device can encode the amount to be transferred into its challenge. The paying device must decrement the register value to reflect the amount that is transferred, and it must have been programmed by the bank to do so only when its current value represents an amount exceeding the payable amount.

The other way to represent electronic cash value is in purely informational form public-key cryptographic tokens with an associated denomination and currency. Such tokens are called electronic coins. Electronic coins must be unforgeable and verifiable solely by using a public key of the bank; their value and currency are independent of tamper-resistance, so that they form a bearer instrument in the same manner as traditional cash does. The security of electronic coins relies on the secrecy of the signature secret key of the bank.

Electronic coins can be implemented with either of two methods, depending on whether payments are verified on- or off-line. In its simplest form, an electronic coin is a pair, <message, digital signature> referred to as a coin of the "two-part form." The coin digital signature is computed by the bank by applying its signature secret key to the coin message. On the assumption that suitable coins are available to pay a specified amount, the paying device encrypts the coins using a session key derived from its secret key, erases the coins from memory, and sends the encrypted coins to the receiving device. The receiving device decrypts to recover the coins, verifies them using the public key of the bank, and then stores them. The encryption prevents wiretappers from copying the coins while they are in transit. With this method, the receiving device must be tamper-resistant as well, because otherwise the received coins could be spent many times over without there being a way to determine the origin of the fraud.

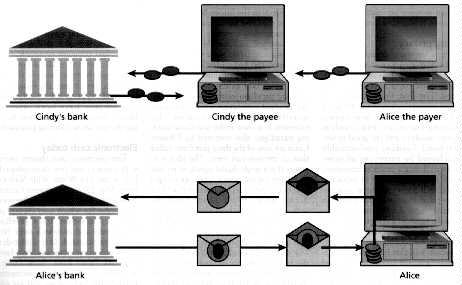

The alternative is for the paying device to encrypt the coins for the bank, using an encryption public key of the bank, instead of for the receiving device. The receiving device must then pass the encrypted coins on to the bank, for decryption and verification [Fig. 2, top]. The advantage of this approach is that the receiving device does not actually get to see the coins, and so cannot reuse them, but the downside is that off-line payment capability is lost.

[2] In a traceable on-line electronic cash system [top], Alice withdraws digital coins from her account at the bank and stores them on her PC. Each coin is of the two-part form, and is associated with a particular denomination and currency (either in the message content or through the bank's choice of signature key). When Alice buys something from Cindy, she sends coins of appropriate denominations over the network to Cindy's shop, encrypted for the issuing bank. Cindy's software automatically sends the coins on to the bank and waits for acceptance. The bank checks the coins against its spent- coin database, and if no match occurs, stores the coins in the database and informs Cindy's bank that it can accept the payment.

Cindy can be reimbursed instantaneously, by being issued new electronic coins; since this process can be transparent, from Cindy's viewpoint she can reuse the coins of Alice to make her own purchases. (Note that Alice's bank knows that Alice has paid Cindy since it knows by whom the deposited coins have been withdrawn.)

In an untraceable on-line electronic cash system [bottom], the bank can be prevented from recognizing to whom the deposited coins have been issued. Instead of the bank creating coins of the two-part form by itself, Alice's computer this time creates the message of each coin by itself, in a random fashion. It then has the bank sign a blinded form of the message, to which end it sends to the bank an arithmetically disguised form of the message. Upon return of the signature on the blinded message, Alice's computer can extract the bank's signature on the original message, by removing the arithmetical disguise from the signature supplied. Alice can then spend the obtained coin as before.

For off-line payment, an electronic coin is best defined as a triple, <secret key, public key, certificate>, or a coin of the "three-part form." The coin secret key belongs to the paying device, and may not be known to anyone else besides the device (and possibly the bank); the coin public key corresponds to the coin secret key, and the coin certificate is a digital signature of the bank on the coin public key. To spend a coin of the three-part form, the paying device computes a digital signature on a challenge message of the receiving device, using the coin secret key, and sends this to the receiving device together with the coin certificate and the coin public key The receiving device cannot reuse the received cash, as it has not been provided with the coin secret key, so cannot by itself compute a digital signature for another challenge. Instead, the receiving device must deposit the coin.

Experience has shown that organized crime can command expertise comparable to that of national laboratories, and even individual computer criminals today have access to sophisticated tools. When secrets from paying or receiving devices can be extracted and abused, counterfeits are indistinguishable from electronic cash issued by the bank. When estimating the expected fraudulent profit that can be made, one also needs to take into consideration the economics of large-scale cracking; to crack a single smartcard, equipment and expertise running into hundreds of thousands of dollars may be needed, but this is largely a one-time investment. The damage that can be done ultimately depends on the measures incorporated in the system for preventing or discouraging unauthorized injection of electronic cash. At the very least, the bank should be able to detect and trace the injection of substantial amounts of forged electronic cash into the system. Once such a forgery has been detected, the bank should then be able to trace it to its source. (The ability to trace forgeries need not necessarily conflict with the inability to trace honest payments, as will be seen below.)

In order to hold a traced party responsible for all or part of the financial damage, it must be possible to isolate that party's liability; for example, so as to have firm ground for holding a traced party liable for the double-spending of coins, it must be ensured that the double-spending is unlikely to have been the work of a thief, unless the traced party ignored all manner of obligatory safeguards. Finally, it should be possible to quickly and efficiently distribute blacklists that enable payees to reject forged money (containment). A secure electronic cash system should provide for all of these .

To account holders, security aspects other than protection against forgery are of importance. The electronic cash held by the device of an account holder should not disappear in any other way than by being spent at the discretion of its legitimate holder. It should also not be possible for attackers to redirect a payment made by a device to any party other than the one intended by the legitimate holder of the device.

Account holders also need to be able to substantiate their position in case of erroneous or false accusations of fraudulent behavior. When parties with different interests authenticate their communications using symmetric authentication, the transcript of a communication cannot later on be used by one party to demonstrate that the communication with the other took place since it could have computed the transcript by itself. True non-repudiation requires the use of secure digital signatures, since these can be computed only by the party associated with the public key needed for verification. When crucial parts of the withdrawal, payment, and deposit requests are digitally signed, all parties can substantiate their position.

Privacy is by many deemed likely to decide the ultimate success of electronic cash with consumers. Two aspects of privacy in electronic payment systems can be discerned. The first confidentiality of transaction content, refers to the ability of account holders to prevent wire-tappers from learning transaction details such as the amount involved and the good or service purchased. Payment confidentiality can be achieved by encrypting all sensitive data sent during a protocol execution .

A more fundamental form of privacy is untraceability. If proper technical measures are not in place, electronic cash payments automatically leave detailed tracing information in the hands of a central party, typically the bank. Straightforward approaches to privacy (anonymous accounts, aggregated transaction logs that hide unique transaction identifiers, and anonymously issued paying devices) downgrade security for the bank by hindering the ability to trace counterfeiters, and at best offer a weak form of untraceability ("pseudo-anonymity"). Namely, payments by the same device are inherently linkable, and user-identification in any one transaction (as when reloading from account) makes all payments of that user traceable.